Creating a housing trust fund seems to be the principal goal of the anti-displacement grant that the city was awarded almost two years ago. During the budget process, Michelle Tullo requested 10 percent of the city's American Rescue Plan Act funds and 50 percent of the lodging tax revenue, for a total of about $200,000, for the housing trust fund. (In the end, $20,000 was allocated for the fund in the 2022 budget.) The "ask" from the Community Benefits Alliance is that 10 percent of the profits from the hotel and restaurant proposed for the Pocketbook Factory go to the housing trust fund. Exactly what the trust fund will do and how it will be operated has yet to be explained to the public. It would seem plans for the housing trust fund are still evolving.

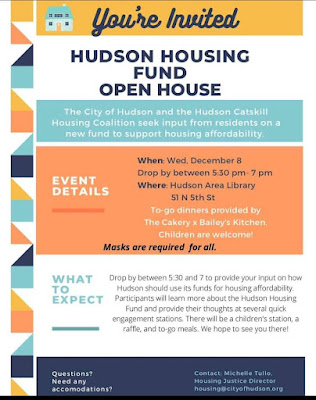

On Wednesday, December 8, there is to be a Hudson Housing Fund Open House from 5:30 to 7:00 p.m. at the Hudson Area Library.

The invitation to the event, reproduced above announces: "The City of Hudson and the Hudson/Catskill Housing Coalition seek input from residents on a new fund to support housing affordability." It is later explained that the input sought is "on how Hudson should use its funds for housing affordability."

Let me get this straight: the Housing Trust Fund is designed to "support housing affordability" -- which is what exactly? Grants to Galvan? Free rent for the mayor (who just got a 25% raise for doing precisely nothing)?

ReplyDeleteAnd who is running it? Ms. Tullo who, in her near 2 year tenure has managed to raise $20k in total? And what is her salary in the commensurate period? Never mind, I don't want to know.

But Ms. Tullo is likely a better choice than the H/CHC run, as it is, by someone convicted of stealing taxpayer money from the City of Hudson.

Anyone else think this is merely an attempt by the City to create a welfare fund it can dole out any way it wants?

I should clarify: I don't mean the ED of the H/CHC or whomever actually helms it. I'm referring to Quentin Cross who is a senior advisor or analyst of something like that to the organization.

DeleteKamal didn't do nothing- he got his landlord a sweet, sweet tax deal that everyone else in Hudson will be paying off for decades. How else do you think he got free rent?

DeleteCity taxpayers and private businesses are not social service organizations. For that you go to DSS. If someone wants to set up a trust fund to help pay peoples rents that's all good, but they need to get their funding from donations and grants, not from extorting local taxpayers and businesses.

ReplyDeleteWhen did the City of Hudson vote to partner with the mysteriously-funded and very sketchy acting Hudson/Catskill Housing Coalition on anything? They talk about themselves as though they serve the community, but as far as I can see they only act as a lobbying arm for the Galvan Foundation, and they aren’t listed as a charity in NY last I checked. Whose name appears on the paychecks? Perhaps Gossips can enlighten us- was there a memorandum of understanding voted on by the Common Council that we all just missed?

ReplyDeleteTheir fiscal sponsor is http://freeholdartexchange.org/

ReplyDeleteThanks, Chad. How did you come about this information? Freehold Art Exchange has been listed as a non-profit since Feb 2017, with no 990 on file with the IRS, so far as I can see, which is not reassuring.

DeleteWelcome to the world of non-profit fund raising and business vacations.

Deletehttp://freeholdartexchange.org/

Deletehttps://www.causeiq.com/organizations/freehold-art-exchange,473212463/

owner or manager piper dorrance

http://freeholdartexchange.org/faex-team/

Follow the Donate button.

ReplyDeleteThe simplest way to help make housing affordable is to give this money directly to those in need or to reduce taxes. I’m afraid that most of it will just go to consultants, endless studies, and the usual “non-profit” grifters that have encircled city hall.

ReplyDeleteAlso, asking a 10% tithe from the Pocketbook Factory is basically extortion.

How is lowering taxes (giving more money to homeowners) going to reduce rents? Subsidized housing already exists and gives money in the form or reduced rents directly to people on need (HHA, section 8)). What is being proposed is a quasi-public entity (housing fund) extorting money from a private business to give away as housing subsidies. That's a crazy idea. Why not just raise taxes on everyone, or charge a housing subsidy fee to every business in town and give that away? What person or group decides who to subject to this new tax and give away the money to? Are they elected or subject to any oversight?

DeleteThe only way to reduce rents is to reduce rents. This is done through city imposed rent caps and regulation. Every crazy round about idea is being proposed, restrict B&Bs, build more apartments, start a housing fund, etc., etc., to avoid this reality, because the folks in govt. simply do not have the nerve to do it.

Rent caps will lead to the most rapid depletion of rental housing stock since the 70s Urban Renewal. Rents ain’t coming down — that is a pipe dream. The solution is living wages and the key to that is education. Or hitting the lottery. Education is a better bet. What you propose has been proven, repeatedly, not to work and in fact is detrimental to the development and sustainability of a vital rental market. What the politicians don’t have the stomach for (among most things) is stating the truth: you can’t live where you can’t afford and there is no such thing as birth right residency.

DeleteCould be, but if you had a large, luxury 2 bedroom apartment that suddenly you could only get $1200 for and you could make it into two smaller one bedrooms that you would be able to collect $2000 for, it might create more apartments.

DeleteBesides the constitutional takings issue your hypothetical poses, you can’t realistically turn a one bedroom into a two bedroom without warehousing people. If you can’t afford Hudson live in Greenport. Etc. that’s how life works.

DeleteP. Winslow, my main point is that I don’t feel Hudson is managed responsibility enough to administrate a fund like this. So we’re in agreement on that point. As we’ve seen with the money from the lodging tax used by the Tourism Board, it gets viewed as a slush fund and is chipped away by fluff and grift. If we have to have a trust fund, it’s better just to give the money away to either tenants or landlord in lieu or rent payments as emergency grants for those down on their luck. I think the fund is foolhardy, but if it’s gonna happen, let’s keep the hands out of the cookie jar.

DeleteAs per how does lowering taxes for homeowners help keep rent affordable? Here’s a hint: Landlords are the homeowners. Tenants pay for tax increases as they get baked into the rent.

As per rent controls, as John points out, and nearly 75 years of data from NYC will show, all that does is pick winners and losers. The lucky and connected will get lower rent. The unlucky and unconnected majority will see increased market rates to balance it out.

I'm not sure many two bedroom apartments can be split into two one bedroom apartments - what about bathrooms, kitchens, and egress?

It’s simply supply and demand. You can try and slow down rent increases by either: increasing the supply with new development, or decreasing demand by making Hudson suck. Many people in this town, including some of the council members and “community” activists seem hellbent on the later.

I know it is an unrealistic idea, kind of like wishing bread was still $.10 a loaf. As far as tax goes, you are counting on the good will of landlords to lower rents if their tax goes down, I doubt that would happen. Taxes are also unlikely to go down anytime soon with a local govt. that spends taxpayer dollars like a spoiled 20 year old writing checks off a billion dollar trust fund.

DeleteNo, but lower property taxes do take some of the pressure to raise rents off small landlords who need to cover their property tax bills.

DeleteWhy is Catskill involved anyway? Are they extorting business over there too? What are Social Services for, and Section 8 if not to look out for people. Our taxes are supporting that, that's enough, folks. We work 7 days a week and round the clock because of the Internet and pay our taxes. I'm tired of grifters and pie in the sky 'asking'.

ReplyDeleteTake away the negative nelly and alas youve got some ideas. Give this money directly to those in need. rent caps and regulation. increasing the supply with new development. Help socials service and section 8 to look out for people

ReplyDeleteCommunism has never actually worked, comrade: you can't have rent caps and expect development except by the cartel that controls the poverty-industry axis which always means an erosion of the tax base. ALWAYS in Hudson in any event. This is a city, not a 2 square mile shelter system. We need everything in an admixture that is both scaled and scalable. That means you can only have so much subsidized anything -- the rest has to be paid for. And that requires an economy. Your ideas, however, would destroy that economy. So then what?

Delete